The autumn always brings a ‘new term’ feeling and brings an energy with it. This year, my daughter, Megan, has started comprehensive school and her excitement levels have shot through the roof…

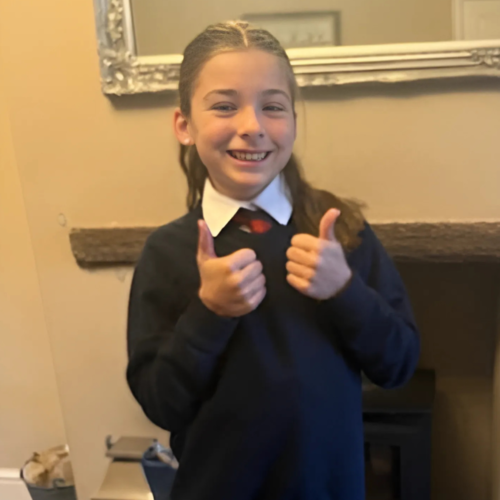

Harnessing that energy makes it a great time to review your finances to make sure everything is running smoothly and you’re as excited about the future as Megan is (pictured below). Here’s a few pointers to help you start the new term.

Assess your spending and saving habits

Recent price rises mean it’s more important than ever to have a solid budgeting plan in place. Sticking to a budget can help you avoid splashing out on things you don’t really need. You might even find you have more money to put towards your savings goals.

Revisit your financial goals

Applying to join the School Council to tackle the school’ s big issues (so far, there’s no salt and vinegar available for school fish n chips!), large scale Stage Plays to audition for and lots of new pupils to meet have already changed Megan’s world.

Post summer, what might have changed for you? It’s a good time to reconsider your future plans. If your plans have changed, you might need to adjust where you are saving your money and the level of investment return needed.

Check your pension is on track

Megan is on track for full attendance and miraculously for her, arriving at school on time every day!

If you haven’t checked the value of your pension pots recently, this is the time to do so. Understanding how much money you’ve saved up in pensions will help you work out whether you’re on track to achieve your retirement ambitions. Are you saving enough?

Make the most of your tax allowances

There are a whole host of other tax allowances and exemptions to make use of each year. The sooner you act, the better your chances are of realising your financial goals. You can invest up to a maximum of £20,000 into ISAs each year to benefit from tax-efficient income and growth and you can withdraw money from ISAs whenever you like without paying tax

Other allowances include the capital gains tax (CGT) exemption, due to be reduced again in April 2025, so you might want to act quickly to maximise your tax-free investment gains.

Review your protection

Having the right protection is crucial to ensure you and your family’s finances hold up in the event of unexpected illness or death. Even if you already have protection, now is a good time to check it still reflects your circumstances.

If the level of cover is too low, your loved ones could be at risk of financial hardship should the worst happen to you. If you have too much cover, you could be saving some cost and putting that money to work better for you.

In summary

Unless she’s spending it, Megan is terrible with her money but at 11 years of age has a lot to improve on.

How will your report card look at the end of term?

For more information on RBC Brewin Dolphin’s services and to contact Greg Tait and the the team in Wales, click here.